Why Strong Pipelines Still Miss Revenue Targets

Table of Contents

ToggleWhat Sales Competency Data Reveals About Qualifying, Closing, and Deal Outcomes

AI Summary

Many sales organizations report healthy pipelines yet continue to miss revenue targets. OMG sales competency data shows a consistent relationship between Qualifying and Closing competencies, suggesting that opportunity volume alone does not predict deal outcomes. When qualification depth is weak, closing effectiveness declines as well. This article examines how misaligned buy cycles, surface-level qualification, and decision process gaps contribute to stalled deals, even when pipelines appear strong.

What the Data Reveals

Sales leaders often assume that strong pipeline coverage reduces revenue risk. When opportunity counts are high, confidence increases. Yet many organizations with robust pipelines still miss quota.

OMG’s sales competency data reveals a recurring pattern. Pipeline creation and deal conversion move together more closely than most teams realize.

From 2022 through 2024, average Qualifying and Closing scores shifted in tandem:

- 2022: Qualifying %, Closing 53%

- 2023: Qualifying 47%, Closing 55%

- 2024: Qualifying 46%, Closing 54%1

Each year that Hunting increased or decreased, Closing moved by a similar magnitude.

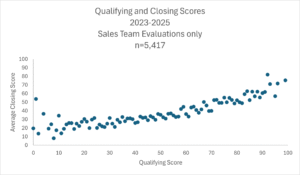

However, year-over-year movement alone does not prove that individual sellers who struggle to qualify also struggle to close. To examine that relationship more directly, we isolated sellers by Qualifying proficiency and measured their average Closing scores.2

The pattern held.

When sellers are grouped by Qualifying score, average Closing scores increase as Qualifying proficiency increases. Lower Qualifying bands consistently show lower Closing averages. Higher Qualifying bands show stronger Closing performance.

This relationship suggests that upstream qualification discipline is associated with downstream deal execution outcomes.

Why Strong Pipelines Still Underperform

While pipeline volume is visible, Qualification quality is, unfortunately, not.

Many organizations measure pipeline strength by opportunity count, stage distribution, and coverage ratios. These metrics reflect activity and progression. They do not necessarily reflect buyer conviction, urgency, or decision alignment.

When Qualifying proficiency is low, opportunities often enter the pipeline without clear financial impact, defined authority, or validated decision processes. Deals may advance through stages but stall late, extend sales cycles, or end in no decision.

Revenue misses frequently originate months earlier during initial qualification conversations.

Buy Cycle Misalignment Is a Leading Indicator of Revenue Risk

Third-party research reinforces this pattern.

Gartner research shows that B2B buying decisions increasingly involve multiple stakeholders and non-linear decision paths. Complexity introduces friction, particularly when sellers advance their process faster than buyers are aligned internally.3

Research from CSO Insights has consistently shown that a significant percentage of forecasted deals are lost not to competitors, but to indecision or internal misalignment.4

These outcomes often trace back to early-stage qualification gaps. When sellers fail to confirm urgency, internal alignment, and financial consequence, opportunities enter pipelines prematurely.

Strong pipelines that miss revenue targets frequently contain deals that were never fully qualified against the buyer’s actual decision process.

The Qualification Discipline That Drives Closing Outcomes

OMG defines Qualifying as the ability to uncover and validate:

- Compelling reasons to buy

- Financial impact and priority

- Authority and stakeholder alignment

- Decision criteria and timeline

- Consequences of delay

Closing competency reflects the ability to gain commitment at appropriate stages of the sales process.

The data shows that when Qualifying proficiency increases, Closing performance improves in parallel.1 This does not suggest that Closing is unnecessary. It suggests that Closing effectiveness is heavily influenced by the depth and rigor of earlier qualification.

Closing struggles often reflect unresolved qualification gaps.

What High Performers Do Differently

Salespeople who consistently convert pipeline into revenue demonstrate several disciplined behaviors.

- They Qualify for Movement, Not Just Fit

High performers confirm whether the buyer is prepared and positioned to act, not just whether the solution addresses a problem.

- They Validate Internal Alignment Early

They identify stakeholders, approval paths, and decision dynamics before advancing deals.

- They Quantify Consequences

They ensure buyers understand the financial and operational impact of inaction, creating urgency grounded in business outcomes.

- They Reconfirm Commitment

Strong sellers revisit urgency and authority throughout the sales process rather than assuming early validation holds.

A Practical Framework for Improving Pipeline Conversion

Organizations that experience strong pipelines but inconsistent revenue can take a structured approach:

- Measure Qualifying and Closing competencies across the sales team

- Analyze Closing performance by Qualifying band

- Identify whether revenue misses correlate with early-stage qualification gaps

- Coach sellers to align opportunities with buyer decision processes

- Reinforce qualification rigor at each pipeline stage

This approach separates pipeline visibility from pipeline viability.

Why This Matters in the Current Selling Environment

As buying decisions grow more complex, the cost of weak qualification increases.

Healthy pipeline metrics can mask execution risk. The teams that consistently hit revenue targets are not necessarily generating more opportunities. They are advancing better-qualified ones.

OMG’s data shows that as Qualifying proficiency rises, Closing performance rises with it. Organizations that treat qualification discipline as a measurable competency rather than an informal skill are better positioned to convert pipeline into predictable revenue.

Revenue reliability begins earlier in the sales conversation than most teams realize.

References

- Objective Management Group. Finding Statistics Tool: Sales Evaluations conducted January 1, 2022 through December 31, 2024. Internal dataset. Average competency scores for Qualifying and Closing.

- Objective Management Group. Analysis of Sales Evaluations conducted January 1, 2023 through December 31, 2025. Internal dataset. Qualifying and Average Closing Scores of Salespeople.

- Gartner. The New B2B Buying Journey and the Rise of No Decision Outcomes. Gartner Sales Research. https://www.linkedin.com/posts/lewisgoldstein_gartner-found-that-40-of-b2b-buying-decisions-activity-7341885521209565184-qoeE

- CSO Insights. 2024 Sales Performance Study. Analysis of forecast accuracy, deal slippage, and no decision outcomes. https://resources.insidesales.com/blog/sales-forecasting-research/